The 8-Minute Rule for Property By Helander Llc

The 8-Minute Rule for Property By Helander Llc

Blog Article

Top Guidelines Of Property By Helander Llc

Table of ContentsGet This Report about Property By Helander LlcProperty By Helander Llc Can Be Fun For EveryoneNot known Facts About Property By Helander LlcWhat Does Property By Helander Llc Mean?The 7-Minute Rule for Property By Helander LlcThe 15-Second Trick For Property By Helander Llc

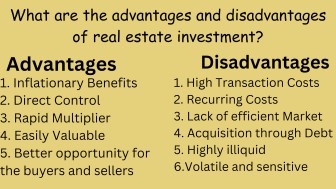

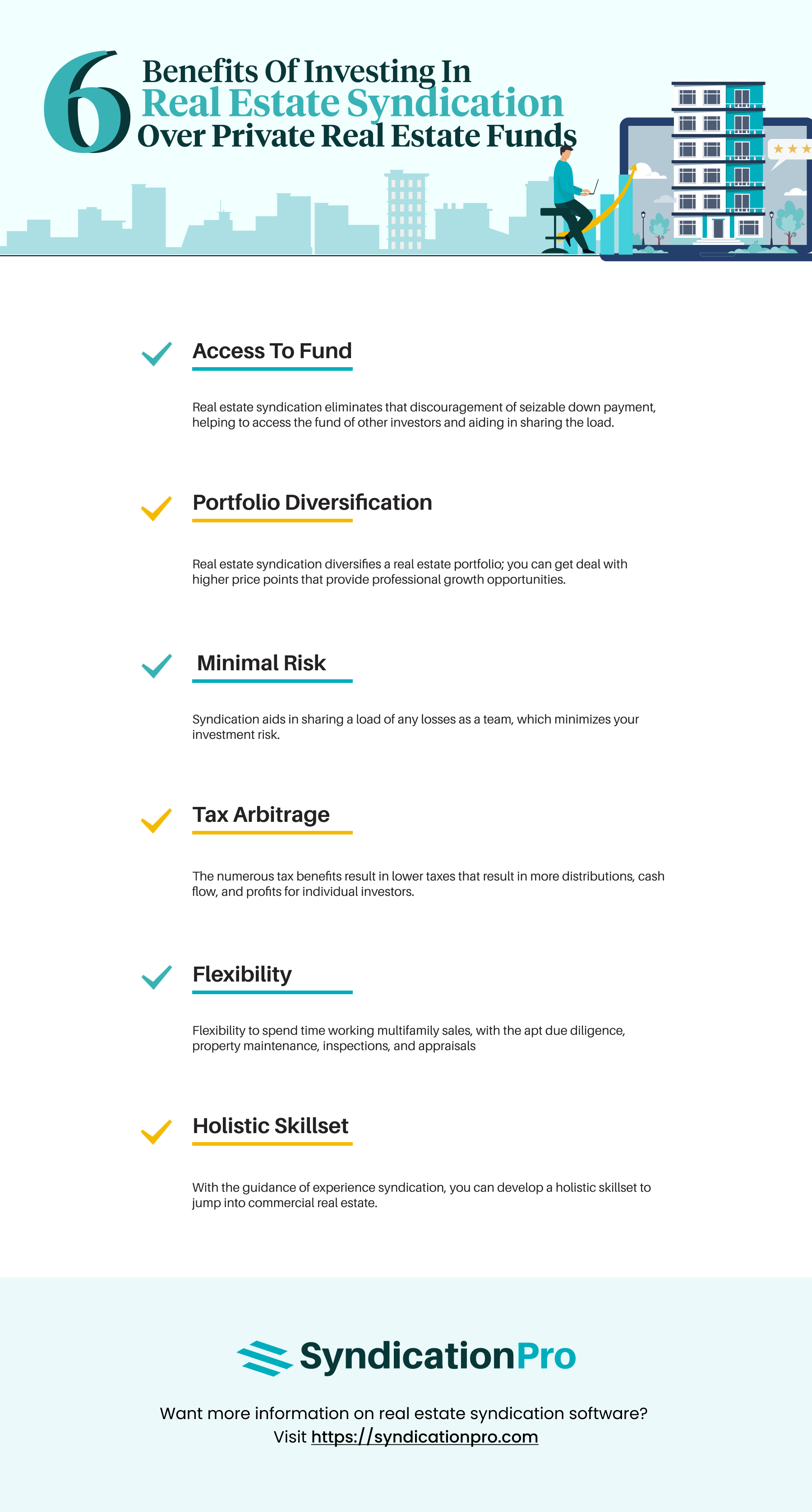

The benefits of purchasing real estate are many. With well-chosen possessions, investors can take pleasure in predictable capital, exceptional returns, tax advantages, and diversificationand it's feasible to leverage realty to construct riches. Thinking of purchasing property? Right here's what you need to learn about genuine estate benefits and why realty is taken into consideration a good financial investment.The advantages of buying property consist of easy earnings, steady cash money circulation, tax obligation benefits, diversification, and leverage. Realty investment company (REITs) use a way to invest in realty without having to have, operate, or money homes - (https://www.nulled.to/user/6251266-pbhelanderllc). Cash flow is the web revenue from a realty investment after mortgage payments and operating budget have been made.

Oftentimes, cash flow only strengthens gradually as you pay down your mortgageand develop up your equity. Real estate investors can capitalize on countless tax breaks and deductions that can save cash at tax time. As a whole, you can subtract the affordable expenses of owning, operating, and taking care of a residential property.

The Best Strategy To Use For Property By Helander Llc

Actual estate worths have a tendency to raise over time, and with a good financial investment, you can turn an earnings when it's time to sell. As you pay down a home home mortgage, you construct equityan property that's part of your web well worth. And as you build equity, you have the take advantage of to get even more properties and enhance money circulation and riches also extra.

Because property is a concrete possession and one that can function as security, financing is conveniently available. Realty returns differ, relying on factors such as place, asset class, and monitoring. Still, a number that several capitalists aim for is to defeat the average returns of the S&P 500what lots of people describe when they claim, "the marketplace." The rising cost of living hedging capability of actual estate comes from the positive relationship between GDP development and the need for real estate.

Fascination About Property By Helander Llc

This, in turn, converts right into higher resources worths. Real estate has a tendency to keep the acquiring power of resources by passing some of the inflationary stress on to renters and by including some of the inflationary stress in the form of capital admiration - Homes for sale in Sandpoint Idaho.

Indirect property investing includes no direct possession of a residential or commercial property or residential or commercial properties. Rather, you buy a swimming pool along with others, where a monitoring firm has and operates homes, otherwise has a portfolio of home mortgages. There are several manner ins which owning realty can shield versus rising cost of living. First, home worths may rise higher than the price of inflation, causing capital gains.

Homes financed with a fixed-rate car loan will certainly see the relative quantity of the month-to-month home loan repayments drop over time-- for circumstances $1,000 a month as a fixed settlement will certainly end up being much less difficult as rising cost of living erodes the purchasing power of that $1,000. (https://sketchfab.com/pbhelanderllc). Often, a main home is not thought about to be a realty financial investment because it is made use of as one's home

Some Known Details About Property By Helander Llc

Despite the help of a broker, it can take a few weeks of work just to find the best counterparty. Still, real estate is an unique asset course that's simple to recognize and can boost the risk-and-return profile of a financier's portfolio. By itself, realty uses capital, tax obligation breaks, equity structure, affordable risk-adjusted returns, and a hedge versus inflation.

Investing in property can be an extremely satisfying and profitable venture, however if you resemble a great deal of brand-new investors, you might be asking yourself WHY you need to be spending in property and what advantages it brings over other investment possibilities. Along with all the outstanding advantages that go along with buying here are the findings property, there are some downsides you require to consider too.

More About Property By Helander Llc

If you're searching for a method to buy into the realty market without having to invest thousands of hundreds of dollars, look into our homes. At BuyProperly, we utilize a fractional possession model that allows capitalists to start with as low as $2500. One more significant benefit of genuine estate investing is the capability to make a high return from purchasing, refurbishing, and re-selling (a.k.a.

Some Known Details About Property By Helander Llc

If you are charging $2,000 lease per month and you incurred $1,500 in tax-deductible expenditures per month, you will only be paying tax on that $500 earnings per month (realtors in sandpoint idaho). That's a big difference from paying tax obligations on $2,000 per month. The earnings that you make on your rental unit for the year is considered rental income and will be taxed as necessary

Report this page